The 3-Minute Rule for Home Buyers Insurance

Wiki Article

Home Buyers Insurance Can Be Fun For Everyone

Table of ContentsThe Best Guide To Home Buyers InsuranceSome Known Factual Statements About Home Buyers Insurance Home Buyers Insurance for DummiesThe Definitive Guide to Home Buyers InsuranceFacts About Home Buyers Insurance RevealedThe smart Trick of Home Buyers Insurance That Nobody is Talking AboutThe Best Strategy To Use For Home Buyers InsuranceA Biased View of Home Buyers InsuranceHome Buyers Insurance - Truths

When it concerns just how you obtain water, wells can also be shielded with coverage on all elements of the well pump, offered the well is the main water source to the house. Not all homes are built in a "cookie cutter" style, and also Select Residence Guarantee enables house owners to get the ultimate satisfaction with complete protection.Give us a telephone call today:.

The Definitive Guide for Home Buyers Insurance

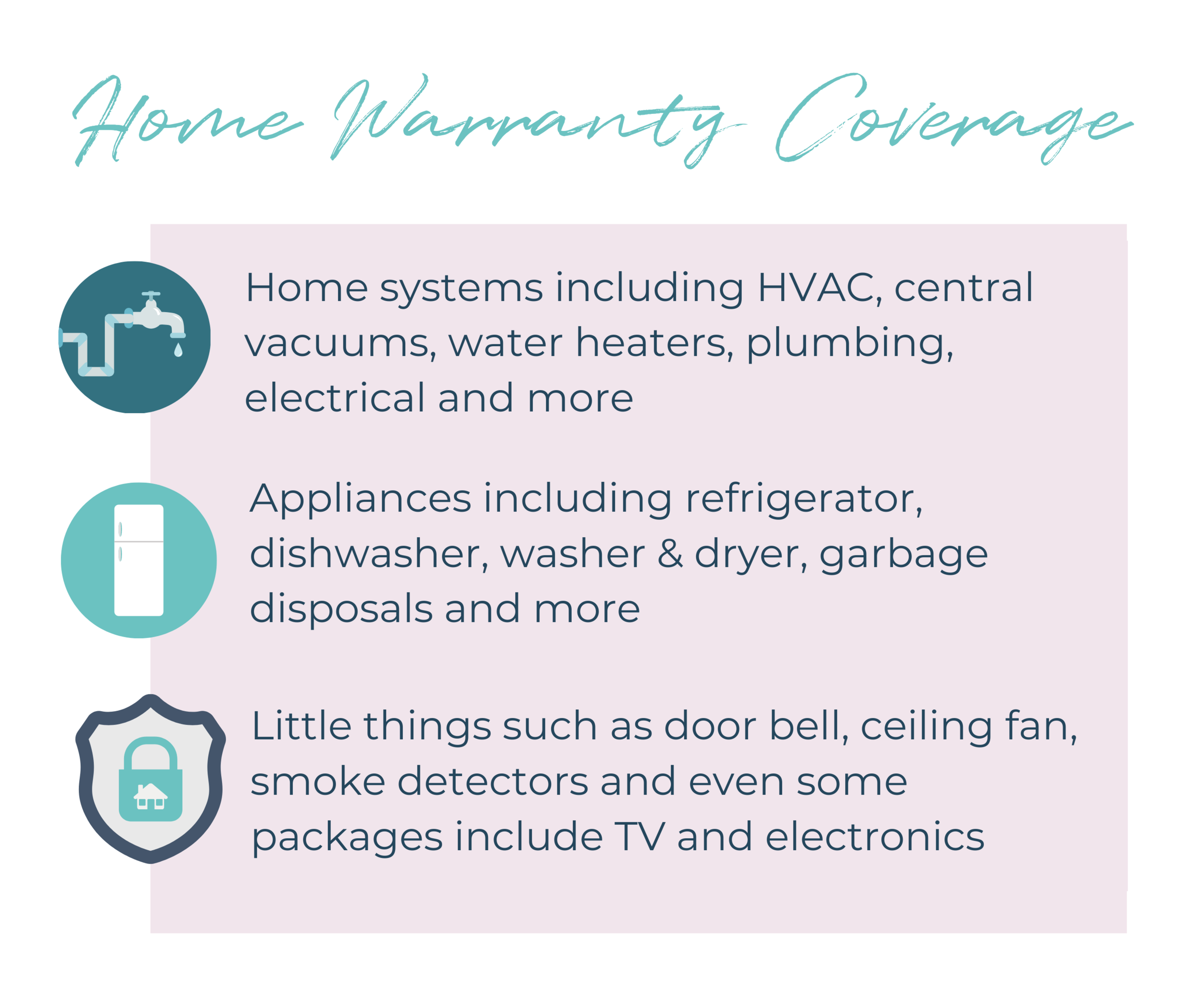

In this post, we'll discover what a house warranty is, what it covers, and also what benefits residence warranty protection can provide to homeowners., which offers 3 levels of insurance coverage, plus add-on alternatives, at a practical rate.Exactly what's covered by a residence service warranty varies depending upon the residence service warranty firm that you utilize as well as the guarantee strategy you authorize up for. Generally, a residence guarantee covers the significant systems as well as appliances in your house.

Home Buyers Insurance for Dummies

Before you authorize up for a plan, it is necessary to read the example agreement as well as to make sure you recognize what is covered and also what isn't. It's usual for a house warranty to omit devices that were incorrectly installed and also things that haven't been well-kept (home buyers insurance). If you're acquiring a residence, it makes feeling to obtain a house evaluation so you know the condition of the systems and devices before you try to purchase a home guarantee.Once more, these limitations will be covered in the example agreement, so review it carefully. When Do You Required A Residence Warranty? A home warranty is a great idea whenever you have devices as well as systems that are out of the supplier's service warranty. home buyers insurance. If your device breaks, you simply call the residence guarantee firm, and the repair work needs to be taken treatment of.

What Does Home Buyers Insurance Do?

They may have utilized many of their financial savings ahead up with the down payment, so a home warranty provides an economic cushion for house repair costs. Owners of older residences. The older any kind of system or device is, the extra most likely it is to damage down. visit our website Numerous home warranties don't exclude home appliances or systems as a result of age.

The Ultimate Guide To Home Buyers Insurance

Your house may be much more appealing to buyers because it provides assurance to know that repairs will certainly be covered if anything stops functioning after shutting. If you buy a brand-new building and construction home, the appliances and systems will be under maker's warranty for a year or two. A house service warranty won't cover things covered by the manufacturer's guarantee, so think about purchasing a home warranty after the warranties the residence included end.

The Definitive Guide to Home Buyers Insurance

Home Insurance Home insurance policy covers your residence for damage that occurs in a disaster or natural disaster, such as a fire or hailstorm. It does not cover a home appliance or home system that gets on the fritz due to the fact that it's old and also starting to break. In those (fortunately) rare instances where your cooking area devices get fried by a lightning strike, you might have the ability to make a claim on your house owner's insurance plan.The cost of a service charge differs by the house service warranty business, and also some companies bill a lower yearly cost if you accept a greater service fee. Various other aspects that influence the expense of a house service warranty include: Geographical place. Homeowners in areas with a greater expense of living may pay even more due to the fact that click here for more info it costs a lot more for the guarantee firm to perform repairs.

Little Known Facts About Home Buyers Insurance.

You might conserve cash by paying your annual fee in one round figure or by paying even more than one year's costs each time, instead of paying every month. Cost Benefits Of A Home Service warranty With a house guarantee, you recognize you won't need to pay full cost to fix or replace protected appliances and systems.If you paid $350 for your home guarantee and also $100 for the solution call, you're still in advance by almost $100 versus paying for a typical water heater repair work of $546 without a warranty. If you require 2 or more solution hire a year for various home appliances which is entirely most likely with an old house you 'd save even a lot more.

5 Easy Facts About Home Buyers Insurance Shown

As an example, if there is a $1,500 restriction under your residence guarantee prepare for air conditioning repair or replacement, after that any expense over $1,500 is your duty. Still, that's $1,500 much less you need to take out of your savings account when the ac system passes away. Our Referral For House Warranty Protection Based upon our research study of the significant players in the house service warranty room, we recommend American Home Shield.

To get a cost-free quote from our top pick, utilize the get in touch with info below:.

The 10-Minute Rule for Home Buyers Insurance

House warranties have actually come to be much extra typical over the past couple of years. Much of this growth has been sustained by the property market, as sellers are often encouraged to provide a home warranty as a device to tempt customers. Furthermore, purchasers will typically ask sellers to include a residence warranty when working out the sales contract.Report this wiki page